This is a great piece of land in a great neighborhood. A long history of active exploration and mining has defined a prolific, regional structure that stretches hundreds of kilometers - and Enchi covers a significant part of it with district-scale, multi-million ounce potential.

Greg Smith, VP Exploration

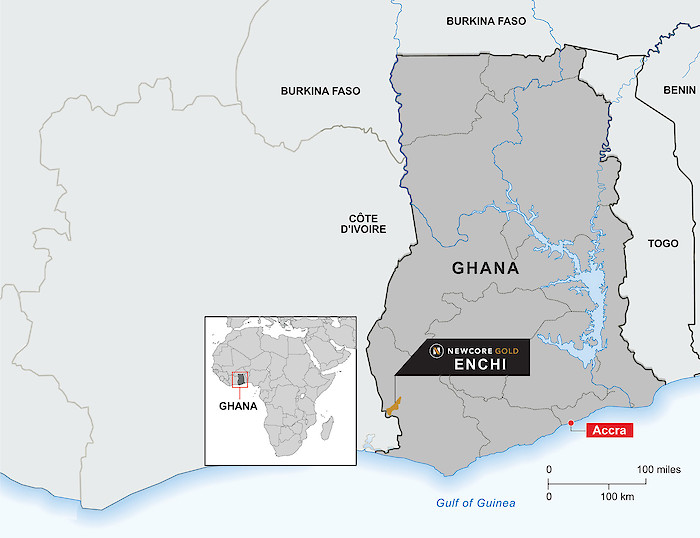

| Locations: | Southwest Ghana |

| Minerals | Gold (Au) |

| Area | 216 km2 |

| Ownership | 100% |

| Status | 1.4 million ounce Inferred1 Mineral Resource Estimate, drilling underway to expand resources |

Overview: On Trend with Some of Ghana’s Most Successful Mines

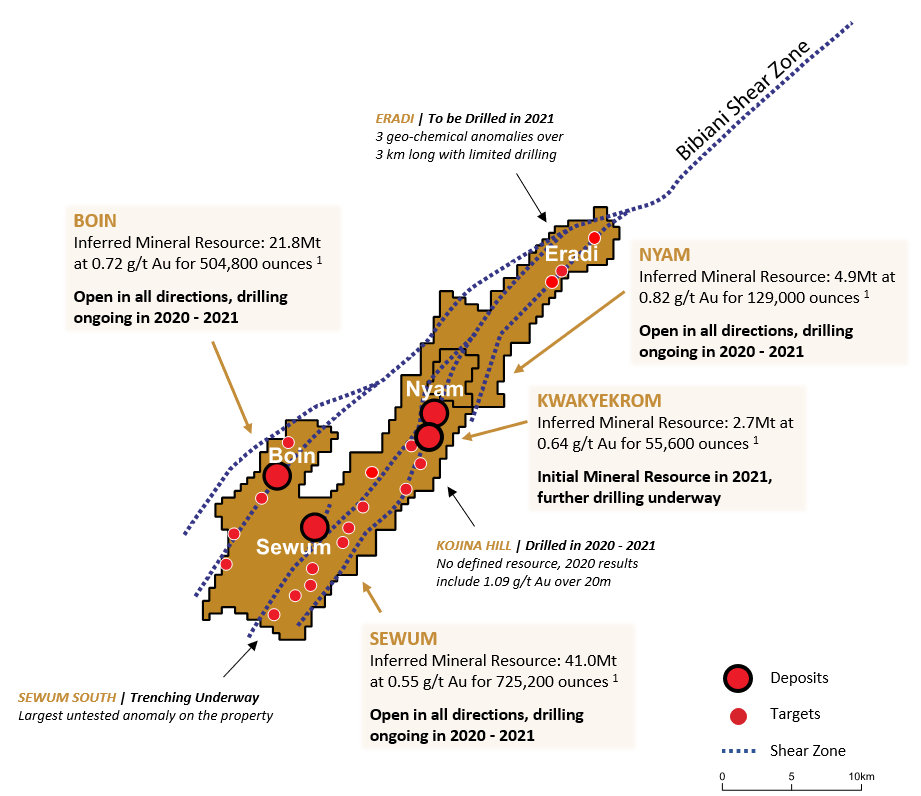

The Enchi Gold Project currently hosts an Inferred Mineral Resource of 1.4 million ounces1 of gold in a district hosting several 5 million-ounce gold deposits. This 216 km2 land package covers 40 kilometers of Ghana’s prolific Bibiani Shear Zone. The property remains substantially underexplored, with several high priority geochemical and geophysical anomalies yet to be tested by drilling.

On Structure with the Chirano Mine

The Chirano Mine, owned by Kinross Gold, is located 50 kilometers to the north. Chirano produced ~165,000 ounces of gold in 2020 and ~200,000 ounces in 2019. Enchi is situated on the same regional structure as Chirano with comparable geology, alteration and mineralization.

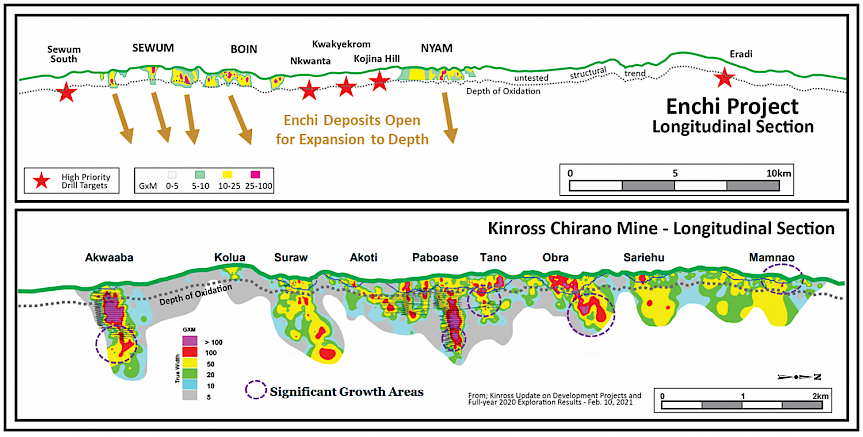

Depth Potential - Comparison with Chirano Mine

The multi-million-ounce Chirano Gold Mine (Kinross Gold) hosts plunging zones of high-grade gold mineralization (see diagram below). The Chirano zones are similar to those found at Enchi, including known zones Sewum, Boin, Nyam and Kwakyekrom. Like Chirano, the zones at Enchi have broad lower grade gold at surface with higher grade core structure extending to depth.

Current Inferred Mineral Resource1

| Inferred Mineral Resource for the Enchi Gold Project | |||

|---|---|---|---|

| Zone | Tonnes | Grade (g/t Au) | Contained Gold (ounces) |

| Sewum | 41,009,000 | 0.55 | 725,200 |

| Boin | 21,807,000 | 0.72 | 504,800 |

| Nyam | 4,892,000 | 0.82 | 129,000 |

| Kwakyekrom | 2,703,000 | 0.64 | 55,600 |

| Total | 70,411,000 | 0.62 | 1,414,600 |

| Cut-Off Grade Sensitivity of Pit Constrained Inferred Mineral Resource | |||

|---|---|---|---|

| Cut-Off (g/t Au) | Tonnes | Grade (g/t Au) | Contained Gold (ounces) |

| 0.10 | 82,210,000 | 0.56 | 1,471,000 |

| 0.20 | 70,411,000 | 0.62 | 1,415,000 |

| 0.30 | 55,550,000 | 0.72 | 1,293,000 |

| 0.40 | 41,619,000 | 0.85 | 1,134,000 |

| 0.50 | 32,689,000 | 0.98 | 1,026,000 |

1 Notes for Inferred Mineral Resource Estimate:

1. CIM definition standards were followed for the resource estimate.

2. The 2021 resource models used ordinary kriging (OK) grade estimation within a three-dimensional block model with mineralized zones defined by wireframed solids and constrained by pits shell for Sewum, Boin and Nyam. Kwakyekrom used Inverse Distance squared (ID2).

3. A base cut-off grade of 0.2 g/t Au was used with a capping of gold grades varied by deposit and zone.

4. A US$1,650/ounce gold price, open pit with heap leach operation was used to determine the cut-off grade of 0.2 g/t Au. Mining costs of US$1.40 for oxide, US$2.10 for transition, and US$2.60 for fresh rock per mined tonne and G&A and milling costs of US$6.83/milled tonne. The Inferred Mineral Resource Estimate is pit constrained.

5. Metallurgical recoveries have been applied to four individual deposits and in each case three material types (oxide, transition, and fresh rock) with average recoveries of 77% for Sewum, 79% for Boin, 60% for Nyam and 72% for Kwakyekrom.

6. A density of 2.20 g/cm3 for oxide, 2.45 g/cm3 for transition, and 2.70 g/cm3 for fresh rock was applied.

7. Optimization pit slope angles varied based on the rock types.

8. Mineral Resources that are not mineral reserves do not have economic viability. Numbers may not add due to rounding.

9. The resource estimate was prepared by Todd McCracken, P.Geo, of BBA E&C Inc in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects. Todd McCracken is an independent qualified person ("QP") as defined by National Instrument 43-101.

10. Mr. Gregory Smith, P.Geo, the Vice-President of Exploration of the Company, is the Qualified Person as defined by NI 43-101, and is responsible for the accuracy of the technical data and information.

11. These numbers are from the technical report titled "Preliminary Economic Assessment for the Enchi Gold Project, Enchi, Ghana", with an effective date of June 8, 2021, prepared by Todd McCracken, P. Geo. in accordance with National Instrument 43-101 Standards of Disclosure for Mineral Projects and is available under Newcore’s SEDAR profile at www.sedar.com.

Excellent Resource Expansion Potential - Laterally and at Depth

Drilling completed at Enchi has averaged a depth of 130 metres to date, with a maximum vertical depth of 250 metres. Most resources and reserves of mines on the Bibiani Trend lie below 200 metres.

Several high-priority gold targets have been identified to expand the already substantial, near-surface oxide resource with multi-million ounce opportunities:

Considering the positive results of the latest resource update, the shallow drilling completed to date and number of untested anomalies, there is excellent potential to expand the current resource.

2020 - 2021 Enchi Drilling Program

A 90,000 metre discovery and resource expansion drilling program is underway at Enchi. The program includes both RC and diamond drilling and will include the first deep drilling planned on the Project. This drill program includes testing extensions of the existing resource areas while also testing a number of high priority exploration targets outside of the Inferred Mineral Resource. Drilling is focused on step out extensions and exploration drilling at the Sewum, Boin, Nyam and Kwakyekrom Deposits. Additional drilling is planned at previously drilled zones that are outside of the resource area (Kojina Hill and Eradi), along with first pass drilling to test a series of kilometre-scale gold-in-soil anomalous zones with no prior drilling (Nkwanta, Sewum South and other anomalies). All zones represent high priority targets based on geological, geochemical and geophysical surface work and previous trenching and drilling.

Newcore Gold initially announced plans to conduct 8,000 metres of drilling to expand the current resource, with a significant increase announced in early November 2020 to expand the drill program by 50,000 metres. The program was later increased in April 2021 to 66,000 metres on the back of strong drill results, with the addition of 8,000 metres of RC drilling, and then further increased in August 2021 to 90,000 metres on the back of continued drilling success and completion of an equity financing. Both discovery and resource expansion drilling is underway. An updated Inferred Mineral Resoure Estimate was announced in conjunction with an updated Preliminary Economic Assessment Study on June 8, 2021. This update only incorporated 20,195 metres of drilling completed as part of the 2020 - 2021 drill program, with an additional 46,000 metres of drilling yet to be included.

The 2020 - 2021 drill program will include both RC and diamond drilling and will include the first deeper drilling planned on the project. RC drilling will be focused on near-surface oxide gold targets while diamond drilling will focus on targets at depth.